Some Of What Is Trade Credit Insurance

Wiki Article

Top Guidelines Of What Is Trade Credit Insurance

Table of ContentsEverything about What Is Trade Credit InsuranceWhat Does What Is Trade Credit Insurance Do?How What Is Trade Credit Insurance can Save You Time, Stress, and Money.What Is Trade Credit Insurance Fundamentals Explained

This is used by some trade financing experts covering the possible delays to settlement which might originate from money transfer restrictions, or the bankruptcy of a federal government purchaser. Our political risk insurance assists organizations to safeguard their abroad investments in situations such as political violence or confiscation of assets, or other dangers relating to the actions of a foreign government.The costs is computed as a portion of the total quantity of revenue being guaranteed, beginning with around 0. 15% of insurable turn over. Sometimes it does work out much higher than this if there is imperfect credit scores history or other red flags. As with any kind of insurance, there is a calculation to be done around threat.

They allocate each of those clients a grade that shows the wellness of their task as well as the means they carry out business. Based upon this risk analysis, each of your purchasers is after that given a certain credit limitation up to which you, the guaranteed, can trade as well as have the ability to case must something fail.

What Is Trade Credit Insurance Things To Know Before You Get This

The warranties will certainly cover trading by residential companies as well as exporting firms and the intent is for arrangements to be in position with insurance companies by end of this month. The warranty will certainly be short-lived as well as targeted to cover Covid-19 economic obstacles, and it will certainly be followed by a testimonial of the TCI market to ensure it can best sustain businesses in future.It is essential to obtain the details right to make sure that the plan benefits businesses and also insurance companies, and additionally provides value for money for the taxpayer. It is essential that insurance companies can preserve their underwriting requirements as well as risk administration techniques, to guarantee that support is used to businesses that can trade out of the current circumstance - What is trade credit insurance.

Given the sudden disturbance to economic task, as well as the raised threats of bankruptcy as well as default in the market, profession credit insurers may immediately take out a few of the insurance coverage that they presently offer in order to continue to be sensible. The alternative would certainly be to raise costs to a degree that is uneconomical for all events.

Profession debt insurance policy plays a specifically significant duty in non-service sectors, such as manufacturing and also construction, providing services the self-confidence to patronize one another. The Federal government is keen to make sure that these sectors are not take into page further distress as a result of the Covid-19 situation. This scheme will make sure that supply chains continue to be secured from the potential cause and effect of profession disturbance as well as business defaults.

What Is Trade Credit Insurance - An Overview

The final system is likely to share similarities with some of the various other treatments launched throughout the continent. However, the information are still being settled by the UK Government as well as being discussed with insurance companies. More detail will be introduced in due course. The government is functioning with industry to finalise the details of the plan.

The Federal government's top priority for this plan is to look at these guys work with insurance providers to sustain UK organizations. It is the Government's intention that this scheme will allow the profession credit report market to run as regular, as far as possible.

All about What Is Trade Credit Insurance

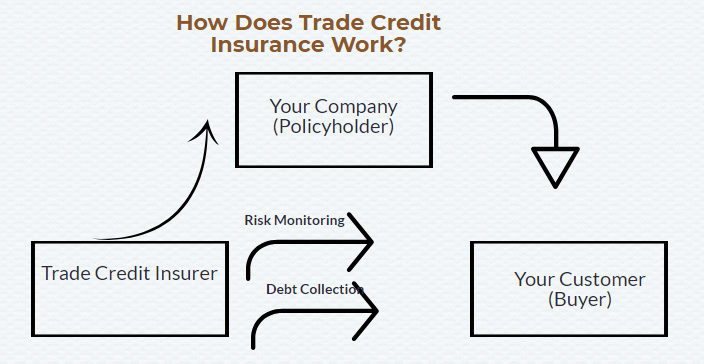

Further information of the plan will be revealed in due course. The Federal government's priority for this system is to support UK companies that could be influenced by the withdrawal of trade debt insurance coverage cover throughout the Covid-19 dilemma. In the longer term, it will be appropriate to examine the effectiveness of this intervention, analyze how the marketplace reacted to financial disruption, as well as take into consideration how it can proceed to ideal offer companies.While the biggest drivers on the market are overseas companies, this is not a bailout for insurance providers. We are working with the insurance providers to best support British organizations. Trade credit rating insurance coverage supplies defense for businesses when consumers do not pay their debts owed for service or products. The plan will certainly reimburse the insurance policy holder in case of the customer's non-payment, approximately a particular credit line set by the insurance firm.

This could exacerbate the financial effects of the pandemic by triggering problems for liquidity and also working capital for buyers and also damaging rely on supply chains.

The sales of products as well as services are revealed to a substantial number of risks, a lot of which are not within the control of the vendor. The highest of these risks and also one that can have a disastrous influence on the viability of a distributor, is the failure of a buyer to pay for the items or services it has actually bought. What is trade credit insurance.

Report this wiki page